Building a solid passive income stream starts with understanding what you’ve got to spare. Whether it’s extra time, skills, money or assets, all are valuable resources that can kick start a successful side hustle.

Creating passive income streams is a great way to achieve your financial goals quicker. When set up correctly they can provide you with financial freedom, flexibility and help reduce your overall financial stress. However, there is a large misconception that passive income is getting money from nothing. Unfortunately, this isn’t the case. When it comes to developing passive income streams, there is usually a need for both an upfront investment and regular initial upkeep in order to establish a stream that will deliver residual income consistently over time.

Buying dividend stocks: if you’ve got money to spare

When it comes to investing in stocks most people buy a share of a company at a cheap price and hold onto it so they can sell that stock at a higher price later, pocketing the cash. While you can apply the same buying and selling principle to dividend stocks, these shares come with an added benefit. A tried and tested way of earning passive income, these companies regularly share a small percentage of profits with shareholders through what is called dividends. Shareholders get a regular sum of money just for owning that stock - you don’t have to sell your shares in order to earn money! The more shares you own, the higher your potential income.

Dividend stocks are a great way to start building passive income if you’ve got a little extra cash. Whether you use a broker or an online trading platform, you’ll need to do a bit of research to figure out which stocks will consistently deliver dividend income. This can take some time, but it’ll be worth it in the long run. Owning dividend stocks doesn’t require much regular upkeep either. Monitor the company’s performance once a month and figure out if you want to withdraw your dividend as cash or reinvest it to purchase more shares, boosting your future dividend income potential. Subscribe to investment advice services like Motley Fool to get up to date information and market leading advice on which investments are right for you.

Developing digital products: if you’ve got spare time and skills

If you’ve spent a large amount of your time getting good at a particular skill or knowledgeable on a certain topic, creating a digital product might be an option for you to earn that passive income. Digital products could include anything from an album on Spotify to an online teaching course or app.

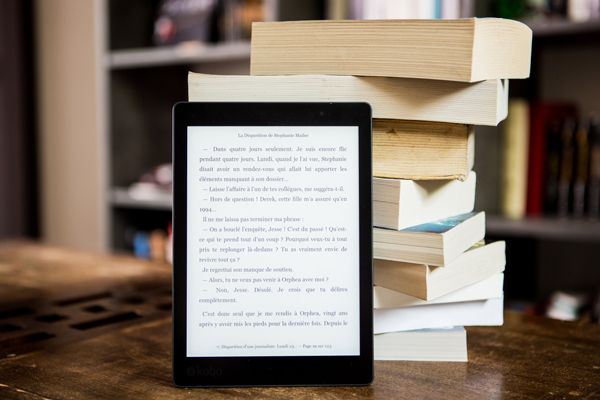

If you’re an expert in your field, digital products allow you to get paid for your expertise while you sleep. Creating an e-book that documents your knowledge on a certain topic might be another great way to start building passive income. You’ll need to write, edit and create a cover then upload it to platforms like Amazon’s Kindle Direct Publishing. Alternatively, you could create an online course to pass your knowledge onto others. Udemy is a popular online platform that many digital producers publish their online courses on because of their large customer base that enjoy regularly taking video courses on a wide variety of subjects. You can also make a little more spare cash if you promote products and services within your videos!

If you’re a budding creative, considering how you can make and sell digital content is a great way to get paid for your art. If you’re a photographer, why not sell your photography on stock photography platforms as a lucrative way to earn money on work you’ve already done? Websites like Etsy are also great for selling prints and other creative goods. If you’re a musician, platforms like Bandcamp are a great way to build a loyal grassroots audience, while also getting paid for your latest album or EP.

Joining the sharing economy: if you’ve got spare stuff

Whether you’ve jumped in an Uber or ordered take away from Deliveroo, then you’ve already engaged with the sharing economy. If you’ve got a spare room or a car you don’t use during the week, maybe there’s an opportunity to make a bit of extra money that you haven’t considered.

Companies like DriveMyCar let you hire your car out when you’re not using it. Users simply sign up to their platform and can hire your car whenever you choose to make it available. There is a lot of demand for these services for those that live in more metropolitan areas like Sydney and Brisbane, with car owners earning up to $1,750 a month via the platform.

Despite regular preparation, cleaning and insurance costs, sharing your underutilised assets with the wider sharing economy can be an extremely lucrative source of passive income.

Shop smarter with Cashrewards

Reaching your financial goals is easier when you’ve got multiple income streams, it’s also easier when you’re saving smarter. Cashrewards makes it easier to save money while you shop, in-store and online. In under one minute you can sign up online for Cashrewards and start getting cashback every time you make a purchase at one of our 1,500+ supported online retailers. Spend just another minute more securely linking your card to your Cashrewards account and you can save even more when you shop in-store. Cashrewards is a smarter way to shop, start today.